You make a plan by making a choice. Effective from 1 November 2021 to 31 April 2022 the gomen will offer a discount of.

Budget 2021 Govt Begins Major Business Rate Reforms Ftadviser Com

In the Budget 2022 announcement the government had proposed to raise stamp duty on share contract notes from 01 per cent to 015 per cent which is equivalent to RM150 for every RM1000.

Duty astamp bajet 2022. For example the Bumiputera Youth Contractor Participation policy was announced in the 2022 budget where the objective was to create a program accelerator by CIDB RM10 j. The below exemption is applicable for sale and purchase agreement executed after 1 January 2021 but not later than 31 December 2025. 15 to those who wish to make a full settlement.

KUALA LUMPUR Oct 29 -- The Perlindungan Tenang Voucher Programme for the lower-income group B40 will be continued next year with the value of the voucher increased to RM75 from RM50 according to Finance Minister Tengku Datuk Seri Zafrul Tengku Abdul Aziz. 10 to those who make repayment through scheduled salary deduction or debit. You decide what you will spend how.

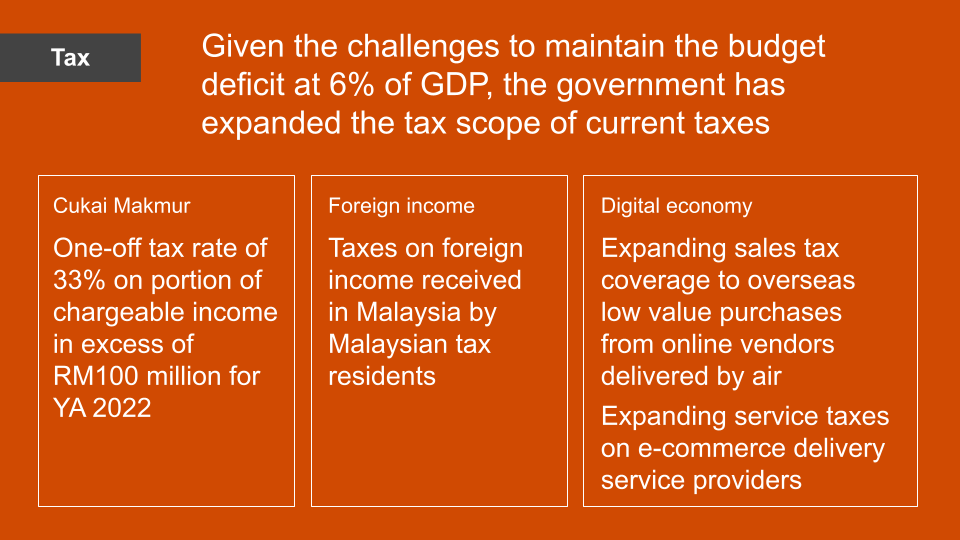

Income tax imposed on Malaysian residents on income derived from foreign sources and received in the country from Jan 1 2022. The government will expand the excise duty of sugared premixed drinks such as malt coffee and tea chocolate or cocoa-based beverages. It also involves private companies where tax collection stamp duty levies and excies duties are imposed on them by the government.

Budget 2022 proposed that stamp duty on contract notes be increased from 01 to 015 starting from 1 January 2022. Public sector net borrowing excluding public sector banks PSNB ex was 131 billion in February 2022 the second-highest February borrowing since monthly records began in 1993. The proposed change would impact larger share transactions.

There is no stamp duty Tax applied to the first 125000. 12 to those who want to settle at least 50 of their loan balance in a single payment. Calculate the stamp duty charged for the purchase of property in England Scotland Wales and Northern Ireland.

This was 24 billion less than in February 2021 but still 128 billion more than in February 2020 before the. For the purchase of only one unit of residential property. The existing RM200 cap for each contract note would also be removed.

24 for resident companies 17 on the first. Stamp duty remains hot topic as experts speculate over possible changes in 2022 Image. Gujarat health sector disappointed says govt did not think about healthcare sector It is frustrating that against our expectations the government has not included any measures to help end the 80-85 import dependence forced upon India said Rajiv Nath forum coordinator of the Association of Indian Medical Device Industry.

In an effort to reduce the cost of ownership of first home for Malaysian citizens the government has proposed the following stamp duty exemptions-. Stamp duty Allowance for spoiled stamps Allowance for misused stamps. Stamp duty is a tax thats charged when you buy a property in the UK but youll only need to pay it if the price of that property reaches a certain threshold.

Currently someone purchasing a 250000 buy-to-let or second home in England will pay 10000. Full Budget 2022 speechINTRODUCING THE SUPPLY BILL 2022 DEWAN RAKYATFRIDAY 29 OCTOBER 2021THEME. GETTY Buyers could save up to 15000 on their property purchase.

From 1 July 2022 any foreign-sourced income remitted to Malaysia will be subject to tax at the chargeable income level at the prevailing tax rate ie. Petrol and diesel costs will increase from midnight tonight with a 60 litre tank of. If the surcharge increases by one per cent this will rise to 12500.

Budget is the expenditure country planning for next years. Stamp duty land tax calculator. Value of Perlindungan Tenang Voucher increased to RM75.

The remittance is applicable for all contract notes from Jan 1 2022 to Dec 31 2026 for all stocks listed on Bursa Malaysia it said. Bajet 2022 baru sahaja dibentangkan oleh Menteri Kewangan YBM Tengku Dato Seri Zafrul Tengku Abdul Aziz pada 29 Oktober lepas di Dewan Rakyat. He said in.

As the property price increases the rate of pay increases within a certain tax bracket. An increase in the surcharge from 3 to 4 would push up the average stamp duty bill on second homes by around 25 from 9500 to 11900 according to Hamptons. This guides got all you need to know about how stamp duty works if youll need to pay it and how the system in Scotland and Wales differs.

Calculate the stamp duty charged for the purchase of property. KELUARGA MALAYSIA MAKMUR SEJAHTERADatuk Speaker SirI would like to propose that a Bill named An Act to use a sum of money from the Consolidated Fund for services for 2022 and to allocate the sum for services. These calculation are based on the current applicable rates.

Contract stamp duty rate increased to 015 per cent and RM200 stamp duty limit per contract note abolished while listed stock trading brokerage activities are no longer subject to service tax. 2022 Budget Bajet 2022 Excise duty expanded to cover sugared premixed drinks New Straits Times KUALA LUMPUR. Customs duty on footwear was hiked from 25 per cent to 35 per cent toys have seen an increase in duty from 20 per cent to 60 per cent while customs duty was doubled on freezers grinders and mixers.

An increase in the surcharge from 3 per cent to 4 power cent would push the average stamp duty bill on second homes up by around 25 per cent according to Hamptons. A budget is a spending plan which is a way to balance the money you have with the money you spend. Carbon tax will rise by 750 per tonne to 41.

How to calculate the new stamp duty rate. That equates to an overall rate of 38 of the sale price or 32500. 184 INCOME TAX CORPORATION TAX STAMP DUTY LAND TAX ENGLAND The Designation of Freeport Tax Sites East Midlands Freeport Regulations 2022 Made - - - - 28th February 2022 Laid before the House of Commons 1st March 2022 Coming into force - - 22nd March 2022 The Treasury make the following Regulations in exercise of the powers conferred.

.jfif)

No comments